Which of the Following Best Describes the Crowding Out Effect

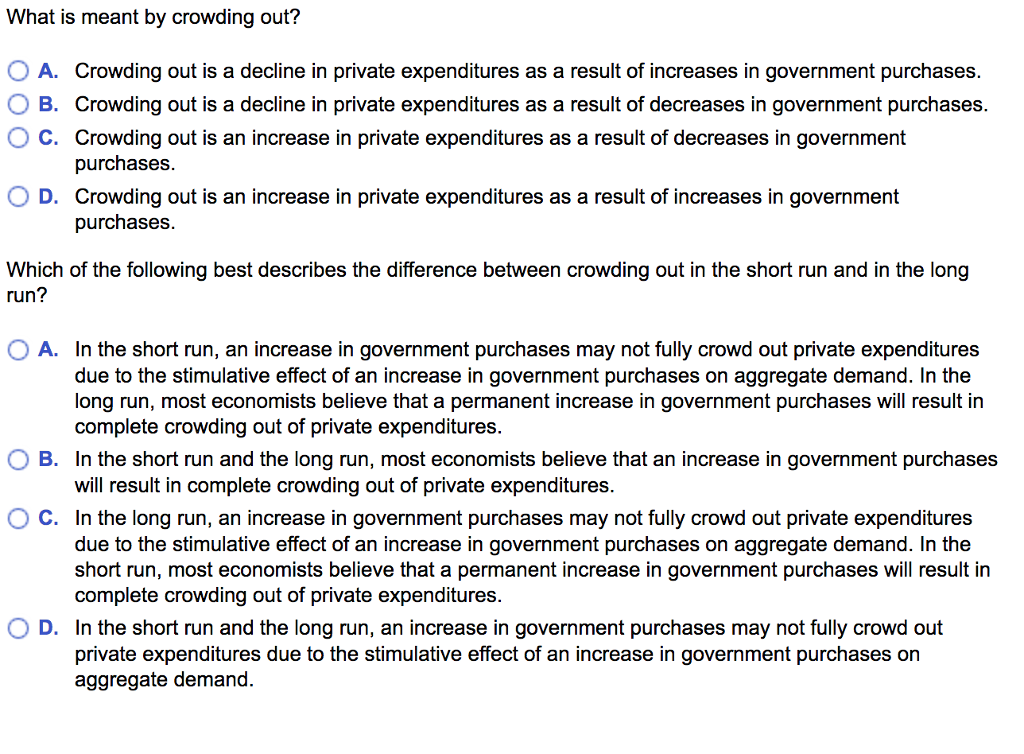

Which of the following best describes the crowding-out effect. Crowding out refers to the situation in which a.

Solved What Is Meant By Crowding Out 0 A O B Crowding Out Chegg Com

Budget deficit is likely to stimulate aggregate demand and cause inflation.

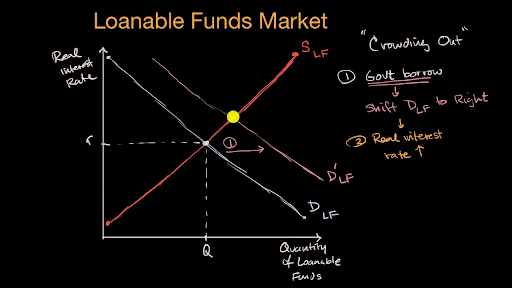

. Raising taxes or borrowing. An increase in borrowing by the government will push interest rates upward which will lead to a reduction in private spending. Borrowing by the federal government raises interest rates and causes firms to invest less.

Which of the following best describes the interest rate effect. The crowding-out effect is an economic theory that argues that rising public sector spending drives down private sector spending. Which of the following best describes the crowding-out effect.

An increase in government expenditures will cause taxes to rise which will reduce both aggregate demand and output. Which of the following best describes the crowding-out effect. Foreigners sell their bonds and purchase US.

Crowding out is a reduction in private-sector borrowing and spending caused by increased government borrowing. With higher interest rates the cost for funds to be invested increases and affects their accessibility to debt financing mechanisms. The crowding-out effect is the offset in aggregate demand that results when expansionary fiscal policy such as an increase in government spending or a decrease in taxes raises the interest rate and thereby reduces investment spending.

Most government borrowing involves selling bonds. Crowding out is most likely to occur when the federal government. The government issues new money which eventually causes inflation.

This leads to lesser investment ultimately and crowds out the impact of the initial rise in the total investment spending. Question 22 5 pts Which of the following best describes the crowding out effect. Which of the following best describes the crowding-out effect.

Sometimes government spending causes an increase in interest rates which leads to a decrease in private spending. This reduces available capital and decreases consumer confidence. The crowding out effect describes the idea that large volumes of government borrowing push up the real interest rate making it difficult or close to impossible for individuals and small companies to obtain loans.

The plan was rejected and civil war broke out between. Which of the following statements best describes a stage in the crowding-out effect. Runs a deficit and sells bonds to make up the difference.

Increased borrowing occurs when the government runs a budget deficit. An increase in government expenditures will cause the general level of prices to fall and thereby reduce aggregate demand and output. Public sector spending is accommodated by increasing taxes or the level of borrowing itself.

The crowding-out effect describes the way government spending reduces private spending. Budget deficit will increase real interest rates and thereby retard private spending. -Sometimes government spending just replaces private spending.

The statement that best describes a stage in the crowding-out effect is The government issues treasury bonds and spends the revenue on a new highway system. Crowding Out Effect Key Takeaways The crowding out. In the long term the crowding-out effect inhibits economic growth and in some cases can.

How Does the Crowding Out Effect Work. The tendency for increases in government spending to cause offsetting reductions in spending in the private sector. An increase in the price level will lead to an increase in interest rates.

Crowding out due to government borrowing occurs when. The crowding out effect is an economic theory arguing that rising public sector spending drives down or even eliminates private sector spending. Budget surplus will be highly effective against inflation.

O An increase in government expenditures will cause taxes to rise which will reduce both aggregate demand and output. The crowding out effect suggests rising public sector spending drives down private sector spending. The government can boost spending by doing two things.

A high magnitude of the crowding out effect may even lead to lesser income in the economy. Borrowing by the federal government causes state and local governments to lower their taxes. An increase in borrowing by the government will push interest rates upward which will lead to a reduction in private spending.

The crowding-out effect implies that a. Crowding out Higher interest rates decrease private sector investment. The government lowers taxes which motivates producers to increase output.

Higher taxes mean consumers and companies have less left over to spend. The government issues treasury bonds and spends the revenue on a new highway system. Assuming that this is a closed economy with no crowding out which of the following best describes the impact that a 100 billion increase in government spending will have on this economy.

The crowding out effect is an economic theory arguing that rising public sector spending drives down or even eliminates private sector spending. If the Fed decreases the money supply. The Crowding Out Effect.

An increase in borrowing by the government will push interest rates upward which will lead to a reduction in private spending The new classical model implies that a shift to a more expansionary fiscal policy the substitution of debt financing for taxes will. When the Fed increases the required reserve ratio interest rates rise which discourages investment If the government increases taxes it needs to borrow more which increases interest rates and discourages investment.

Crowding Out Effect And Why It Matters Fourweekmba

Crowding Out Video Crowding Out Khan Academy

Solved Question 10 1 Pts Which Of The Following Best Chegg Com

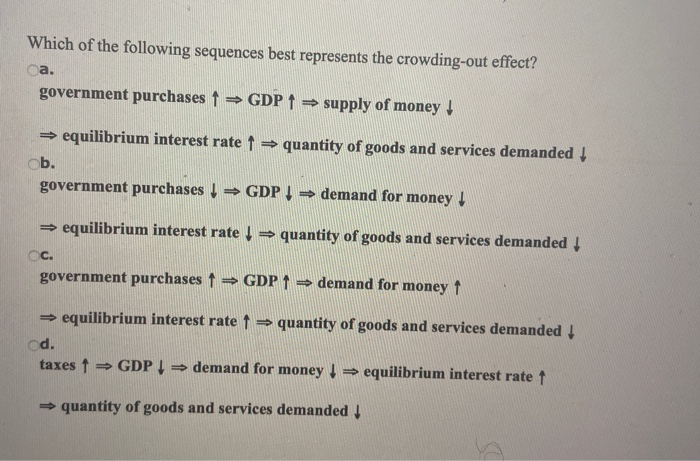

Solved Which Of The Following Sequences Best Represents The Chegg Com

Belum ada Komentar untuk "Which of the Following Best Describes the Crowding Out Effect"

Posting Komentar